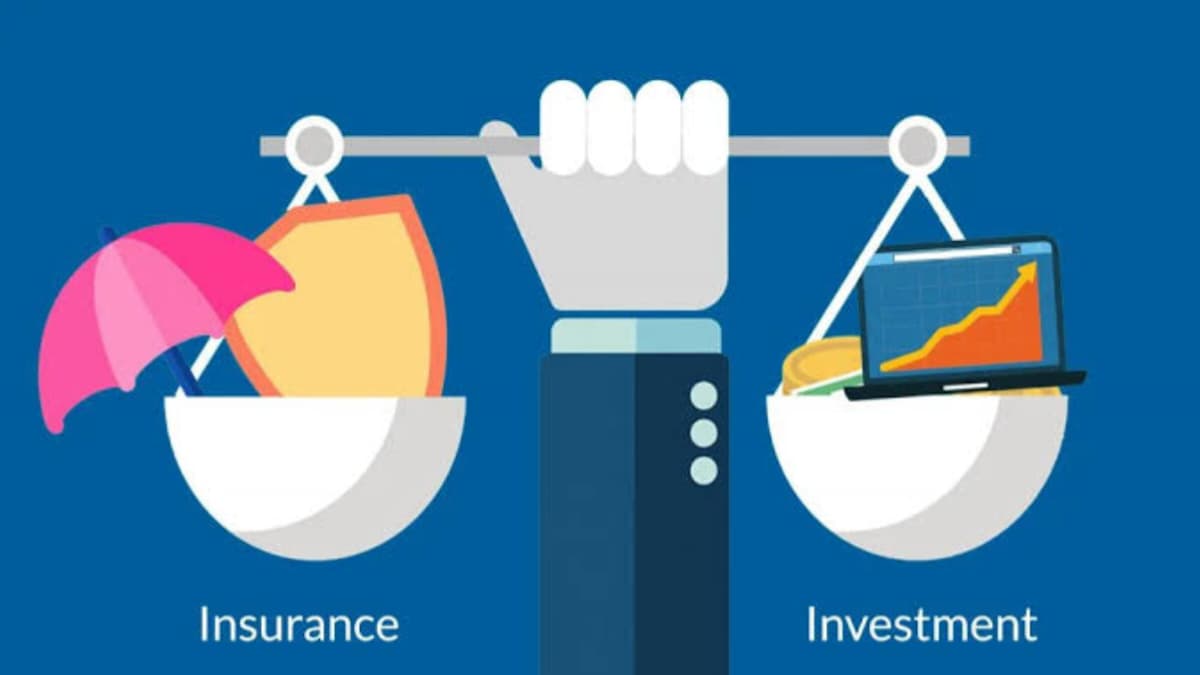

A Unit-Linked Insurance Plan (ULIP) is a unique type of insurance product that combines the dual benefits of insurance and investment under one policy. This type of plan is particularly suited for individuals who wish to build wealth over the long term while ensuring financial security for their loved ones. In a Unit-Linked Insurance Plan, part of the premium you pay goes towards life insurance coverage, while the remaining portion is invested in various funds, such as equity, debt, or a combination of both, depending on your risk appetite. Here, we’ll delve into the key features, benefits, and considerations of a Unit-Linked Insurance Plan, providing you with a comprehensive understanding of how it works and its potential impact on your financial planning.

Key Features of a Unit-Linked Insurance Plan

- Dual Benefit of Insurance and Investment

One of the defining characteristics of a Unit-Linked Insurance Plan is its combination of insurance coverage and investment potential. This allows policyholders to achieve their long-term financial goals while also providing a financial safety net in the event of the insured’s demise. The insurance portion guarantees that the beneficiaries receive a payout if the insured person passes away, while the investment component allows the policyholder to build wealth through market-linked returns. - Investment Flexibility

A Unit-Linked Insurance Plan offers flexibility in investment choices, which is a unique feature compared to traditional life insurance policies. Policyholders can choose from a range of investment funds based on their risk tolerance and financial goals. Typically, ULIPs offer options such as equity funds, debt funds, or balanced funds. Equity funds are usually suitable for individuals with a higher risk appetite, while debt funds are ideal for those seeking stability and lower risk. Balanced funds, on the other hand, provide a mix of both, balancing risk and reward. - Fund Switching Options

Most Unit-Linked Insurance Plans come with a fund-switching feature, allowing policyholders to move their investments between different funds. This is especially advantageous during market fluctuations, as it enables policyholders to shift from high-risk funds to safer ones or vice versa based on their assessment of market conditions. The flexibility to switch funds adds to the appeal of a Unit-Linked Insurance Plan, as it enables investors to actively manage and adapt their investments according to their evolving financial needs. - Lock-In Period

Unit-Linked Insurance Plans have a mandatory lock-in period, typically lasting five years. During this period, policyholders cannot withdraw their investments, which encourages long-term financial discipline. The lock-in period also provides an advantage to investors, as staying invested for a longer duration allows for the compounding of returns, which is essential for wealth accumulation. This feature of a Unit-Linked Insurance Plan is particularly beneficial for individuals with long-term financial objectives, such as retirement planning, children’s education, or buying a home. - Tax Benefits

Like other insurance products, a Unit-Linked Insurance Plan offers tax advantages. Under Section 80C of the Income Tax Act, policyholders can avail themselves of deductions on the premium paid. Additionally, the maturity proceeds are exempt from tax under Section 10(10D), provided certain conditions are met. This dual tax benefit enhances the attractiveness of a Unit-Linked Insurance Plan, making it a tax-efficient investment option.

Benefits of Investing in a Unit-Linked Insurance Plan

- Potential for Wealth Creation

A Unit-Linked Insurance Plan is structured to facilitate long-term wealth creation through investment in market-linked instruments. By staying invested over a longer period, policyholders can benefit from the compounding effect of returns. The ability to choose between different funds and switch among them allows policyholders to optimize their investment strategy, making a Unit-Linked Insurance Plan an effective wealth-building tool. - Protection for Loved Ones

The insurance coverage in a Unit-Linked Insurance Plan ensures that the policyholder’s family is financially protected in case of unforeseen events. This death benefit is paid to the beneficiaries, which can act as a critical financial cushion during challenging times. Combining this protection with the investment component, a Unit-Linked Insurance Plan provides both security and financial growth. - Transparency

Transparency is a core advantage of a Unit-Linked Insurance Plan, as it provides detailed information about the allocation of funds, charges, and policy performance. Policyholders are provided with regular updates on the performance of their chosen funds, enabling them to track their investments closely. This transparency helps policyholders make informed decisions and adjust their investment strategy if needed. - Goal-Oriented Savings

A Unit-Linked Insurance Plan is designed to help policyholders achieve specific financial goals, such as funding higher education, buying a home, or planning for retirement. Since the investment component grows over time, ULIPs can help policyholders systematically accumulate wealth to meet these milestones.

Important Considerations Before Choosing a Unit-Linked Insurance Plan

- Charges and Fees

While a Unit-Linked Insurance Plan offers numerous benefits, it’s important to be aware of the charges associated with it. Common charges include premium allocation charges, fund management charges, policy administration fees, and mortality charges. These fees can affect the overall returns of the policy, so it’s crucial to understand the fee structure before committing to a ULIP. - Market-Linked Returns and Risk

Since the investment component of a Unit-Linked Insurance Plan is subject to market fluctuations, there is a degree of risk involved. Equity funds, for instance, can yield high returns in a bullish market but may also incur losses in bearish conditions. Therefore, policyholders should assess their risk tolerance and investment goals before opting for a specific fund type within the ULIP. - Long-Term Commitment

A Unit-Linked Insurance Plan is most beneficial when held for the long term due to the lock-in period and the market-linked nature of returns. Policyholders should consider their ability to commit to regular premium payments over several years and their readiness to stay invested for the entire policy term. - Partial Withdrawal Options

After the completion of the lock-in period, many Unit-Linked Insurance Plans allow partial withdrawals. This feature can provide liquidity when needed, helping policyholders meet financial requirements without fully surrendering the policy. However, these withdrawals may impact the final maturity amount, so they should be used judiciously.

Who Should Consider a Unit-Linked Insurance Plan?

A Unit-Linked Insurance Plan is ideal for individuals who are looking for an integrated approach to life insurance and investment. It is particularly well-suited for those with long-term financial goals and a desire to accumulate wealth over time. Young professionals, parents planning for their children’s future, and individuals looking for retirement savings can benefit from the disciplined investment approach that a ULIP provides.

In conclusion, a Unit-Linked Insurance Plan is a versatile and efficient financial tool that combines the benefits of insurance and investment. By carefully evaluating the fund options, charges, and risk levels, individuals can use ULIPs to meet their specific financial objectives. With a disciplined approach and a long-term perspective, a Unit-Linked Insurance Plan can provide both financial protection and growth, making it a compelling option for wealth creation and financial security.