What You Need to Know

When you purchase a new car, you’re making a significant investment. However, if you find yourself in an accident or your car is stolen, you might face a financial gap between what you owe on your auto loan and what your car is actually worth. This is where GAP insurance comes into play.

What is GAP Insurance?

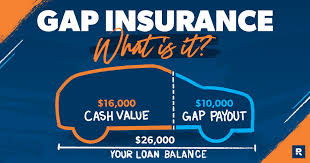

GAP insurance, or Guaranteed Asset Protection insurance, is a type of coverage designed to bridge the financial gap between the actual cash value (ACV) of your vehicle and the remaining balance on your auto loan or lease in the event of a total loss. Unlike standard auto insurance, which only covers the car’s current market value, GAP insurance ensures you’re not left paying out-of-pocket for the difference.

Why Do You Need GAP Insurance?

When you buy a car, it depreciates the moment you drive it off the lot. If you’re involved in an accident or your car is stolen, your standard auto insurance will only compensate you for the current market value of the car, not the amount you still owe on your loan or lease. For example, if you owe $30,000 on your car but it’s worth $25,000 at the time of the accident, you’d be responsible for the $5,000 difference without GAP insurance.

How Does GAP Insurance Work?

In the event of a total loss, GAP insurance covers the difference between your car’s ACV and the amount you owe on your loan or lease, minus your deductible. For instance, if your car’s ACV is $25,000, you owe $30,000 on your loan, and you have a $500 deductible, GAP insurance would cover the $5,000 difference plus your $500 deductible, totaling $5,500.

Benefits of GAP Insurance

- Financial Protection: It ensures you’re not stuck with a debt for a car you no longer have.

- Peace of Mind: Knowing you’re covered against potential financial shortfalls.

- Affordability: GAP insurance is relatively inexpensive compared to the financial protection it offers.

Who Should Consider GAP Insurance?

GAP insurance is especially beneficial for those who:

- Made a Small Down Payment: Lower down payments mean you owe more relative to your car’s value.

- Have a Long Loan Term: Longer loans increase the chance of owing more than the car’s worth.

- Drive a High-Depreciation Vehicle: Some cars lose value faster than others.

Conclusion

GAP insurance is a valuable addition to your auto insurance policy, offering essential financial protection in case of a total loss. While it’s not always mandatory, it’s a wise choice for many car buyers to ensure they’re not left financially vulnerable.

By understanding what GAP insurance covers and assessing your own situation, you can make an informed decision about whether this coverage is right for you.