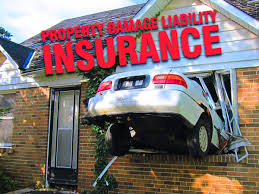

What Every Driver Should Know

When you’re driving, the risk of accidents is an ever-present concern. While we all strive to drive safely, accidents can still happen. This is where Property Damage Liability Insurance comes into play—a critical component of auto insurance that provides financial protection in the event you cause damage to someone else’s property.

What is Property Damage Liability Insurance?

Property Damage Liability Insurance is a type of auto insurance coverage that pays for the costs of repairing or replacing property that you damage in an accident where you are at fault. This property typically includes vehicles, fences, buildings, or any other physical structures. Unlike collision coverage, which pays for damage to your own vehicle, Property Damage Liability covers the damages inflicted on others.

Key Features of Property Damage Liability Insurance

Coverage for Damages: If you cause an accident that damages another person’s car or their property, this insurance covers the repair or replacement costs. For example, if you accidentally rear-end another car or hit a mailbox, Property Damage Liability will cover the expenses of those damages.

Legal Requirement: Most states require drivers to carry a minimum amount of Property Damage Liability Insurance as part of their auto insurance policy. This legal requirement ensures that drivers can compensate others for damages they cause, promoting financial responsibility on the road.

Financial Protection: Property Damage Liability Insurance shields you from the financial burden of paying for damages out-of-pocket. Without this coverage, you could face significant repair costs or even legal action if you’re responsible for extensive property damage.

Why is Property Damage Liability Important?

Meets Legal Obligations: Having this insurance ensures you comply with state laws and avoid legal penalties. It is a fundamental part of auto insurance that upholds the principle of financial responsibility for accidents.

Prevents Financial Hardship: The costs associated with vehicle repairs or property replacement can be substantial. Property Damage Liability Insurance helps cover these costs, preventing you from facing significant financial strain or personal liability.

Peace of Mind: Knowing you have coverage in place allows you to drive with confidence, knowing that you are prepared for the unexpected.

Who Should Consider Increasing Their Property Damage Liability Limits?

While every driver needs to have Property Damage Liability Insurance, some might benefit from increasing their coverage limits beyond the state minimum. Consider raising your limits if you:

- Frequently Drive in High-Traffic Areas: Higher traffic increases the likelihood of accidents that could lead to significant property damage.

- Own a High-Value Vehicle: If you drive a luxury or expensive car, having higher coverage ensures you can handle the costs associated with damaging other high-value properties.

- Want Comprehensive Protection: For drivers seeking the highest level of protection, increased liability limits provide extra security and peace of mind.

How Does Property Damage Liability Insurance Work?

In the event of an accident, you file a claim with your insurance company detailing the damages caused. The insurance company then evaluates the claim and compensates the damaged party up to your policy’s coverage limits. If the damages exceed your limits, you would be responsible for the additional costs.

Conclusion

Property Damage Liability Insurance is an essential component of your auto insurance policy that provides crucial protection against the financial consequences of causing damage to others’ property. By understanding its importance and considering higher coverage limits, you can ensure you’re adequately protected on the road. This insurance not only helps you meet legal requirements but also offers financial security and peace of mind, making it a wise investment for every driver.

By prioritizing Property Damage Liability Insurance, you’re not just adhering to legal obligations but also safeguarding yourself against potential financial burdens and contributing to a culture of responsible driving.